What insurance does a roofing contracter need to carry in San Diego?

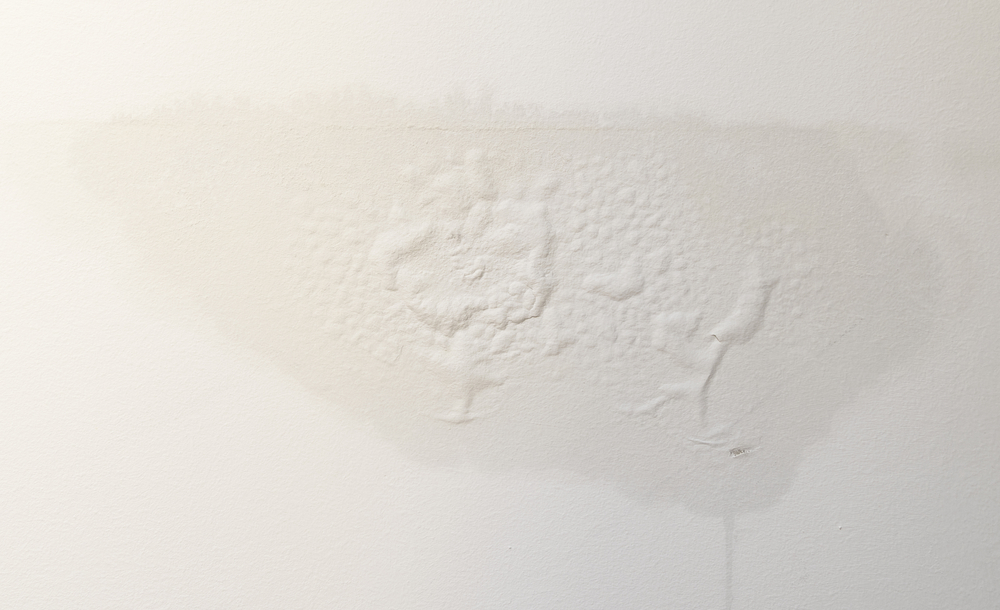

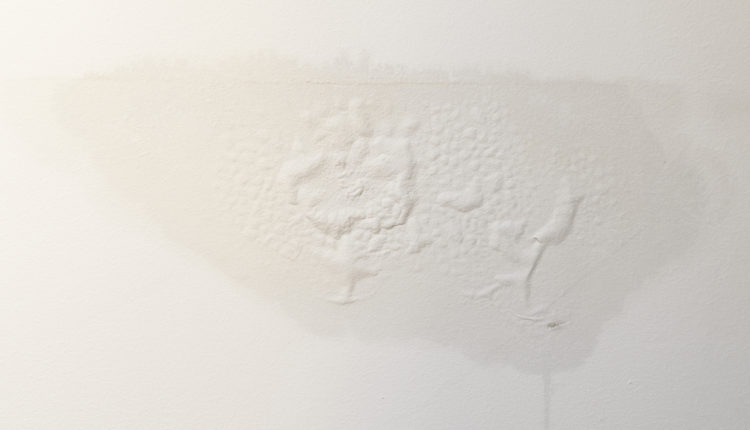

Ever had a leaking roof on a rainy night? It’s like trying to plug holes in a sinking ship. You race against time, frantically using pots and pans to catch the dripping water while you wait for professional help. Now imagine being that professional roofer – responsible not just for fixing leaks but ensuring people’s homes stay safe from nature’s elements.

This is why what insurance does a roofing contractor need to carry in San Diego isn’t just some boring legal requirement—it’s about making sure your business can stand strong amidst potential storms, literally and figuratively!

You’ll learn all about liability insurance covers, workers’ compensation necessities, how different policies protect both contractors and clients alike from unforeseen mishaps on the job site. This knowledge could save you thousands of dollars down the line.

So, are you all set to make your place weather-resistant?

Table Of Contents:

Contents

- 1 Table Of Contents:

- 2 Understanding the Insurance Requirements for Roofing Contractors in San Diego

- 3 The Importance of Insurance Coverage for Roofing Contractors

- 4 Types of Insurance Policies for Roofing Contractors

- 5 Benefits of Carrying Insurance as a Roofing Contractor in San Diego

- 6 Understanding Workers’ Compensation Insurance for Roofing Contractors

- 7 The Role of General Liability Insurance for Roofing Contractors

- 8 Finding the Right Insurance Coverage for Your Roofing Contractor Firm

- 9 Understanding the Coverage Provided by Roofing Insurance Policies

- 10 FAQs in Relation to What insurance Does a Roofing Contracter Need to Carry in San Diego?

- 11 Conclusion

Understanding the Insurance Requirements for Roofing Contractors in San Diego

If you’re a roofing contractor in sunny San Diego, insurance isn’t just a suggestion—it’s an absolute must. But what type of coverage should you carry? This question can be complex, as different policies cover various aspects of your business.

The Necessity of Roofing Insurance in San Diego

You need to protect your roofing company from potential damages and liabilities. In fact, did you know that local roofing insurance policies often cover any financial losses incurred by property damage claims against them?

This is where having adequate roof insurance comes into play. As with any job site involving potentially dangerous tasks and materials, accidents can happen on the roof too. These mishaps may lead to serious injury or even property damage—situations where liability and compensation insurances prove their worth.

The Role of Liability and Compensation Insurance

Risk management begins with good insurance,. The right policy doesn’t just safeguard your business; it protects clients as well. Take general liability: this form shields businesses from claims arising due to bodily injuries or property damage caused during operations.

A typical scenario might involve falling roofing materials causing harm—an unfortunate incident indeed—but one which would fall under the purview of such a policy.

In addition to this safety net for customers’ properties, there’s another vital aspect needing attention – workers’ safety. For instance, if an employee gets injured while working at height (which let’s face it is part-and-parcel of being a roofer), Workers’ Compensation steps up covering medical expenses and lost wages.

Having both types of insurance is essential for a roofing contractor in San Diego. Not only does it ensure that you’re ready to handle any unexpected situations, but it also builds trust with clients who know they’re dealing with professionals taking every precaution possible.

Key Takeaway:

Roofing contractors in San Diego need to be ready for anything, and that includes having the right insurance. This isn’t just about protecting your business from potential damages—it’s also about making sure you can cover any claims made against you. Having both general liability and workers’ compensation insurance is crucial because it helps safeguard your clients as well as your employees.

The Importance of Insurance Coverage for Roofing Contractors

Working as a roofing contractor in San Diego is not without its risks. Working as a roofer in San Diego necessitates more than simply having the appropriate skills and tools; it also requires proper insurance coverage. From general liability to workers’ compensation, adequate protection plays an essential role in any successful roofing business.

Risks Associated with Inadequate Insurance Coverage

Let’s paint a picture here: imagine hiring day laborers or “guys with trucks” to handle your roof repairs – seems cost-effective, right? But what happens if something goes awry? Property damage, substandard workmanship, even injuries on the job site can lead to extra costs and legal headaches.

In fact, if these contractors lack sufficient insurance coverage such as commercial auto insurance, you could be left holding the bag for damages caused by their negligence. Now that doesn’t sound like much fun at all.

This scenario underlines why professional outfits like Christian Roofing prioritize robust insurance policies. Not only does this shield them from potential financial fallout but it also safeguards their clients from unexpected expenses related to property damage or accidents during roof installation or repair projects.

So whether you’re climbing ladders daily handling San Diego roofs yourself or simply looking out for your home’s best interests – understanding what insurances are needed by roofing companies can save you some serious hassle down the line. Remember folks – good fences make good neighbors…and great roofers carry solid insurance coverages.

Types of Insurance Policies for Roofing Contractors

Working in the roofing industry can be a risky endeavor, which is why it’s essential for every roofer to carry insurance coverage tailored specifically for their trade. From physical injuries to property damage, a lot can go wrong on a job site. That’s why it’s essential for every roofer to carry insurance coverage tailored specifically for their trade.

The first type of policy roofers need is workers’ compensation insurance. This cover kicks in when an employee gets hurt on the job. It helps with medical bills and lost wages during recovery, making sure your team feels safe and secure while working.

General Liability Insurance

General liability insurance, another must-have, protects you from claims that could arise from accidents or damages occurring at work sites. If something goes awry – say a tile slips off a roof and dents a car below – this policy has got you covered.

Small Business Insurance: A Comprehensive Solution?

If these policies sound like they’re adding up fast, don’t worry. There are small business insurance products designed just for tradespeople like yourself. These packages often combine general liability and workers’ compensation into one easy-to-manage plan – saving time and potentially some cash too.

Your Materials Matter Too.

Last but definitely not least, let’s talk about insuring those expensive roofing materials against theft or damage while stored at your premises or en route to the job site.An all-risk installation floater provides comprehensive protection – peace of mind worth having indeed.

Benefits of Carrying Insurance as a Roofing Contractor in San Diego

Being insured is more than just meeting legal requirements; it’s about safeguarding your roofing business. With the right insurance, you can handle unexpected events like property damage or injuries without crippling financial burdens.

Property Insurance, for example, covers any losses related to your business properties and roofing materials. So if a fire damages your warehouse full of shingles and tar paper, this policy helps cover repair costs.

Your workers are crucial assets too. But what happens when they get injured on the job site? That’s where Workers’ Compensation Insurance steps in. It handles medical bills associated with work-related injuries – everything from minor cuts to serious falls. Having such coverage not only takes care of your team but also protects you from potential lawsuits.

Adequate insurance also plays a key role in maintaining client trust and winning new contracts because savvy homeowners know that working with an insured contractor minimizes their risk too. If an accident occurs causing damage to their home during roof installation or repair, they’re relieved knowing that liability coverage will take care of expenses.

The Added Bonus: Business Interruption Coverage

No one likes downtime—especially not business owners. An unforeseen event like equipment theft could bring operations grinding to a halt until replacements arrive—a costly delay indeed.

This is where Business Interruption Coverage comes into play—an often overlooked gem within commercial policies—it helps mitigate lost profits during forced shutdowns due to covered risks.

Finding Your Perfect Fit: Tailored Coverage

Each roofing contractor firm is unique—so why settle for a one-size-fits-all insurance policy? Work with an experienced San Diego insurance company that understands the local market and can tailor policies to fit your specific needs. After all, adequate coverage isn’t about spending more; it’s about investing wisely.

In conclusion, having appropriate insurance coverage is essential for people living in San Francisco.

Key Takeaway:

Insurance isn’t just a legal checkbox for San Diego roofing contractors, it’s vital protection. It covers unexpected property damage or injuries on the job, keeping your business safe from financial strain. Plus, with policies like Business Interruption Coverage and tailored options that fit your unique needs, you can minimize downtime and make smart investments in your company’s future.

Understanding Workers’ Compensation Insurance for Roofing Contractors

It provides coverage if one of your employees gets hurt on the job. This is especially crucial in industries like ours where injuries can be severe.

When an employee suffers from an injury at work, this type of insurance covers their medical bills and wages while they recover. In return, the worker agrees not to sue the employer for negligence related to their injury.

In San Diego and across California, all businesses with employees are required by law to carry workers’ compensation insurance. That includes us as roofing contractors too. But that’s not just because it’s mandated by law; we believe in taking care of our team here at Christian Roofing.

The Importance of Carrying Workers’ Compensation Insurance

Accidents happen – even when every safety measure has been taken into account. Falling off roofs or being hit by falling objects are real risks associated with roof repair jobs. Without proper workers’ compensation coverage, these incidents could leave a business owner footing hefty hospital bills or facing costly lawsuits.

Besides covering medical expenses and lost wages due to workplace accidents or illnesses, carrying adequate workers’ comp also protects employers from potential litigation costs down the line.

Finding The Right Coverage For Your Needs

Picking out suitable workers’ comp coverage isn’t always straightforward though – there’s no “one size fits all”. You have options depending on your specific needs as a small business owner dealing with commercial property repairs like ourselves at Christian Roofing. You should look closely into each policy offered before making any decisions about which plan best suits your company’s needs.

So, remember folks – if you’re a roofing contractor or own a business in the industry like us at Christian Roofing, workers’ compensation insurance isn’t just important – it’s indispensable. It’s critical to have workers’ comp insurance not only for safeguarding your company and personnel from financial difficulty, but also as a sign of concern for the welfare of your staff.

Key Takeaway:

Workers’ compensation insurance is a must-have for roofing contractors in San Diego, covering medical costs and lost wages if an employee gets injured on the job. But it’s not just about compliance; this coverage also shows your team that their safety matters to you. Remember, choosing the right policy isn’t one-size-fits-all – it should suit your specific business needs.

The Role of General Liability Insurance for Roofing Contractors

Roofing is a high-risk profession. A simple slip can lead to significant injuries, not just for the workers but also potentially causing property damage. That’s where general liability insurance steps in.

This type of coverage is crucial as it protects against bodily injury and property damage claims that could arise from roofing work. It’s like having a safety net, allowing roofers to focus on what they do best – fixing roofs.

But let’s view this through a larger image. Picture yourself as a homeowner hiring contractors to repair your leaky roof; you’d want them covered by insurance if something goes wrong, right? That’s why carrying such an insurance policy isn’t just good practice—it’s essential for all roofing contractors in San Diego.

Bodily Injury Coverage

In the world of roofing, accidents can happen at any time—a roofer might lose their footing or tools may fall off the roof causing harm below. Bodily injury coverage under general liability insurance takes care of medical bills resulting from these unfortunate incidents. H&M Insurance Agency, one among many providing such services, gives peace-of-mind knowing that help with costs associated with accidental injuries is available when needed.

Property Damage Protection

No matter how careful we are mistakes occur and sometimes result in damages beyond the job site itself—like broken windows or damaged landscaping caused by falling debris during repairs or installations. Better Business Bureau.

A solid general liability policy covers these unforeseen damages saving both contractor and client potential headaches down the line. To put it simply: think about this cover as protecting everyone involved—the home-owner won’t be left with extra repair costs and the roofing contractor firm won’t face crippling financial consequences.

Protecting Your Business

A robust general liability policy can save a lot of money in potential damages. It’s more than just a good idea—it’s essential for any San Diego roofing contractor to ensure they’re adequately covered against risks associated with their work.

Key Takeaway:

Roofing in San Diego is no joke – it’s filled with risks, making general liability insurance essential for contractors. This isn’t just a safety net, it’s peace of mind that covers any bodily harm or property damage from work accidents. It safeguards not only the hardworking crew but also homeowners who bring them on board. Imagine having medical bills covered after unforeseen incidents and being insured for unexpected damages even outside job sites.

Finding the Right Insurance Coverage for Your Roofing Contractor Firm

Choosing the right insurance coverage as a roofing contractor can be tricky. Striking a balance between necessary coverage and affordability is essential when selecting insurance for your roofing contractor business.

H&M Insurance agency, for instance, offers various insurance products tailored to meet the needs of San Diego roofing contractors. Their policies typically include general liability, workers’ compensation, and property damage coverages. This mix is crucial because it provides comprehensive protection against potential pitfalls in this line of work.

The cornerstone of any good business insurance program should be general liability policy. Liability insurance covers damages to properties or injuries that may occur on the job site due to accidents or negligence. So if your employee accidentally drops some heavy roofing materials causing injury or property damage – you’re covered.

Risks Associated with Inadequate Insurance Coverage

In contrast, not having sufficient coverage can lead to devastating financial consequences when something goes wrong at work—imagine dealing with expensive lawsuits out-of-pocket. Not an appealing picture indeed.

Apart from shielding your firm from claims related to bodily harm and property damage, appropriate coverage also caters for business interruption. For example: What happens if a fire ravages your storage facility leading loss of valuable equipment? With adequate business interruption inclusion in place—you are sorted.

The Role Of Workers Compensation In A Roofer’s Policy

Moving forward, another key aspect that every responsible San Diego roofing contractor firm should prioritize is worker’s compensation insurance—it protects employees who get injured while executing their duties by covering medical bills and lost wages during recovery time.

To sum up; remember this golden rule while choosing suitable cover: An ideal roofing insurance policy should cover all the areas of your business that are exposed to risk. Therefore, consult with a reputable Better Business Bureau accredited insurance company and get expert advice on which policies suit your firm best.

Key Takeaway:

Choosing the right insurance as a roofing contractor in San Diego is all about balance. Aim for policies like those offered by H&M Insurance, covering general liability, workers’ compensation, and property damage. Remember – adequate coverage can save you from costly out-of-pocket lawsuits or business interruptions. Also, don’t forget to prioritize worker’s comp to protect your employees.

Understanding the Coverage Provided by Roofing Insurance Policies

When it comes to roofing insurance policies, they serve as a safety net, offering financial protection for both roofing contractors and their clients. But what exactly do these policies cover? Let’s delve into that.

A typical insurance policy for roofers has two major components: general liability and workers’ compensation.

Covers Damages from Property Damage or Injuries

General liability insurance covers damage caused to properties during a roofing project. This means if your contractor accidentally causes damage to your property while replacing your roof, you won’t have to bear the repair costs yourself – the contractor’s insurance will handle it.

The same applies when there are bodily injuries on site due to workmanship errors. The responsibility of covering medical bills falls on this part of the policy, ensuring victims don’t suffer financially because of an accident at a job site.

Potential Workers’ Compensation Claims Covered

The other essential component is workers’ compensation coverage, which provides help when employees get injured while working on roofs in San Diego. It’s crucial given how high-risk roofing jobs can be – one misstep could lead to severe injury or even death.

If such unfortunate events occur, this portion of the insurance coverage takes care of associated medical expenses. Moreover, if recovery requires time off work, this benefit also offers wage replacement assistance allowing affected individuals some peace-of-mind during recuperation.

To wrap up our discussion about what kind of damages these insurances protect against; suffice it to say, they carry a heavy burden. The insurance provides financial relief from unforeseen events that can happen during roof repair or installation projects.

The best part is, all this protection isn’t just for the contractors – homeowners also get peace of mind knowing their property and pocketbook are safe from potential roofing mishaps.

Key Takeaway:

Roofing insurance policies, with general liability and workers’ compensation as key components, offer a safety net for both contractors and clients in San Diego. They cover property damages or injuries caused during the project, medical bills from work accidents, and wage replacement for injured employees. This financial protection provides peace of mind to all parties involved in roofing projects.

FAQs in Relation to What insurance Does a Roofing Contracter Need to Carry in San Diego?

Are California contractors required to carry liability insurance?

Yes, in California, contractors must have general liability insurance. It safeguards against lawsuits and other financial liabilities that result from accidents or mishaps.

What insurance is required in California?

In addition to workers’ compensation for employees, businesses like roofing contractors also need commercial auto and general liability insurances. They help cover any unexpected costs due to incidents on the job.

Do roofers need insurance in Texas?

Absolutely. Roofing contractors operating in Texas should carry both General Liability Insurance and Workers’ Compensation Insurance. These policies protect them from potential risks related to their work.

Conclusion

What a journey we’ve had! You now understand the ins and outs of “what insurance does a roofing contractor need to carry in San Diego”.

You’re aware that proper insurance coverage isn’t just about legal compliance. It’s your safety net, protecting you from unforeseen calamities on the job site.

We delved into liability and compensation policies – two essentials every roofer should have under their belt. They don’t just protect your business but also provide reassurance for your clients.

Above all, remember this: being adequately insured is more than ticking off boxes; it’s safeguarding people’s homes…and their peace of mind!

Comments are closed.